Newsletter: 174

Date: October 8, 2024

China and the World

Globalization is showing that as in a game, some win and others lose.

China’s rise as the world’s second-largest economy has shifted the economic center of gravity toward Asia, challenging the Western economic hegemony that prevailed for much of the 20th century.

China is promoting a new model of economic development based on state investment, industrial planning, and strategic protectionism, which defies the norms and rules of international trade set by the West.

China’s growing investment in research and technological development is leading to increasingly intense competition with the United States and other Western countries in key sectors such as artificial intelligence, robotics and renewable energy.

China’s rise contributes to a more multipolar world, where power is distributed among several great powers rather than concentrated in a single one. This could lead to a more complex and less predictable international system.

China is forging new alliances and regional blocs, which challenge the influence of the United States and its allies.

China’s economic success has led to the spread of its development model in other countries, especially in developing countries.

China’s rise represents a fundamental shift in the world order, with implications for global governance, human rights, and democratic values.

Donald Trump’s recent victory, however, can change the world landscape in all aspects.

During his first term, Trump pursued protectionist policies and imposed tariffs on imported goods, particularly from China and, to a lesser extent, from the European Union. A second Trump administration could see a return to this strategy, affecting the flow of global trade and making goods and raw materials more expensive.

Trump prefers bilateral agreements over multilateral agreements, seeking individual advantages for the U.S. This could discourage large trading blocs such as the European Union and pressure smaller countries to negotiate individually, weakening multilateral trade cooperation.

Trump has been critical of U.S. dependence on Chinese manufacturing and, upon re-election, could escalate the “trade war” against China, enforcing more sanctions and promoting “decoupling” policies. This would affect global supply chains, encouraging other countries to reduce their dependence on China as well.

Trump has already shown some distance from traditional commitments to NATO, demanding greater contributions from European countries. A second term may cause a rift in the alliance, generating tensions within NATO and weakening cooperation on security issues.

It is possible that Trump will resume his criticism of the European Union’s trade surplus and apply tariffs on European products (as has already happened with steel and aluminum). This could trigger a series of retaliations and trade tensions that would affect strategic sectors in both economies.

Trump has expressed his disdain for climate change agreements such as the Paris Agreement. A lack of alignment on environmental and technology policies (e.g., on digital regulation and privacy) could lead to more distance between the US and the EU. For example, during his election campaign he has announced several times the end of the electric car in the US and heavy tariffs on car manufacturers that do not have production plants in the United States

Relationship with China.- Trump, who considers China a strategic threat to the US, could intensify trade and technological restrictions. This would affect tech companies in both nations and could lead to other countries being forced to choose between U.S. and Chinese technology, affecting the development and adoption of global technology.

With increased pressure to decouple the U.S. and Chinese economies, global supply chains would have to adjust, possibly reducing efficiency and increasing costs for multinational companies and consumers. This can also affect the employment market in several countries dependent on manufacturing and exporting to China and the US.

Trump’s stance toward China could increase the risk of conflicts in the Asia-Pacific, particularly in the South China Sea or Taiwan, which would generate regional instability and could involve other international actors, increasing the risk of military confrontations.

Global Security and World Order.- Trump has shown a penchant for reducing the role of the US as “world policeman”. This could leave power vacuums that other actors, such as China or Russia, would seek to fill, which could change the distribution of power and generate more tensions in conflict zones such as the Middle East and Asia.

Its skeptical stance toward international organizations such as the U.N. and NATO could diminish the ability to respond multilaterally to global crises, both security and humanitarian, and make it easier for rival powers to expand their influence.

Trump has prioritized a containment strategy against China’s technological advance, and this is likely to continue in his approach to cybersecurity and technology. This can intensify the technological arms race and make cyber espionage and state-sponsored attacks more frequent.

The PET market.

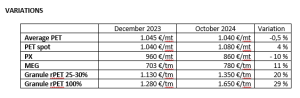

Once the summer campaign is over, the PET market enters a phase of relaxation, however, and compared to other years at this time, demand is more sluggish and uncertain about the direction of its price.

In 2024, the polyethylene terephthalate (PET) market in Europe and Spain continues to be marked by upward trends, especially in recycled PET, driven by demand in the food and beverage sectors. The European Union has set targets to include at least 25% recycled content in PET packaging by 2025, which has led to investments in recycling infrastructure and an increase in recycled PET prices. Currently, the supply of recycled PET is unable to meet demand, which has significantly raised its cost, with prices in Europe reaching €1,690/Mt, doubling compared to the previous year. This presents a challenge for manufacturers, who are exploring expansions in their recycling capacity to meet regulatory targets and market demand

In Spain, the market for recycled PET is also growing, with local companies looking to expand their capabilities in response to high demand. With the EU’s continued investment and sustainability policies, the PET market is expected to remain competitive and in high demand in the coming years

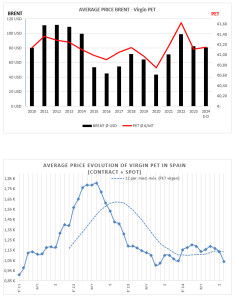

BRENT

The price of Brent oil is currently (8.11.24) around $73.87 per barrel, experiencing a slight weekly gain of approximately 1.42%. This value reflects a drop from the highs of the beginning of the year, which reached $92.18 per barrel, driven by several supply and demand factors in the energy market.

Projections for the price of Brent in 2024 vary between 77 and 85 dollars per barrel, according to estimates by different financial institutions such as Morgan Stanley and Barclays, who forecast downward pressure due to the increase in supply and certain adjustments in global demand. At the same time, other analysts believe that the price could remain at an average level or even exceed $80 in 2025 in the event of production tensions

| MINIMUM PRICE | MAXIMUM PRICE | AVERAGE PRICE | |

| January ’24 | 74,79 USD | 84,80 USD | 79,15 USD |

| February | 76,62 USD | 84,31 USD | 81,72 USD |

| March | 81,08 USD | 87,70 USD | 84,67 USD |

| April | 85,79 USD | 92,18 USD | 89,00 USD |

| May | 80,65 USD | 85,89 USD | 83,00 USD |

| June | 76,66 USD | 87,22 USD | 82,22 USD |

| July | 78,43 USD | 87,95 USD | 83,88 USD |

| August | 75,05 USD | 82,40 USD | 78,88 USD |

| September | 68,68 USD | 77,63 USD | 72,76 USD |

| October | 69,68 USD | 80,55 USD | 75,02 USD |

ECONOMIC INFO

The six Spanish banks listed on the Ibex 35 have closed the first nine months of 2024 with record profits of 23,656 million euros, which represents an increase of 19.7% compared to the same period last year, according to the results presented by the entities in recent days. This strong growth occurs in a context of change for the sector, as the Spanish government, with the support of the PNV, has introduced amendments so that the current tax on banks, which taxes their interest margins and commissions, becomes a permanent tax.

Among the banks that are part of the Ibex 35, Banco Santander continues to lead in profit volume with a net profit of 9,309 million euros, 14.3% more than in the same period last year. In second place is BBVA, with €7,622 million, representing a notable increase of 27.9%. CaixaBank is in third place with a profit of €4,248 million, registering a growth of 16.1%.

Other banks such as Banco Sabadell and Bankinter have also shown positive results, with increases of 26% and 6.8% respectively. However, the most outstanding case in terms of relative growth is that of Unicaja, which has experienced an increase of 58.2%, reaching a profit of 451 million euros.

GDPR: Data Protection Information of MARSELLÀ GLOBAL S.L. (smarsella@marsellaglobal.com):

PURPOSE: To inform you of our products and services by electronic means. LEGITIMATION: Legitimate interest in keeping you informed in your capacity as a client and/or user. ASSIGNMENTS: Not contemplated. CONSERVATION: During the contractual relationship and/or until you request us to cancel the contract and during the periods required by law to meet any liabilities once the relationship has ended. RIGHTS: You can exercise your right of access, rectification, deletion, portability of your data and limitation or opposition in the email of the responsible party. In the event of disagreements, you can file a complaint with the 72Data Protection Agency (www.aepd.es).

This newsletter is prepared based on the information and experience of our sales team. Marsella Global, SL pays special attention to its preparation, however, we cannot guarantee the accuracy and usefulness of the content published.

The recipient accepts the content of this newsletter on the understanding that Marseille Global, SL is not responsible for any damage caused by the use of the information contained in this document.

Comments are closed.