Bulletin: 169

Date: 3th April 2024

INTRODUCTION

Analysis of the Spanish and European Economy as of Today (April 3, 2024)

This analysis provides an overview of the current state of the Spanish and European economies, highlighting their key indicators and challenges.

Spanish Economy:

Growth:

Spain has experienced economic growth above the European Union average in 2021, 2022, and is expected to do so in 2023 and 2024.

Forecasts point to Spanish GDP growth of 1.4% in 2024, compared to the European average of 1.3%.

This growth is driven by domestic demand, tourism, and exports.

Employment:

The unemployment rate in Spain has decreased significantly in recent years, standing at 12.6% in February 2024.

The unemployment rate is expected to continue declining in the coming months, albeit at a slower pace.

Job creation is concentrated in the service, tourism, and construction sectors.

Inflation:

Inflation in Spain has risen in recent months, reaching a year-on-year rate of 7.6% in March 2024.

This increase is mainly due to higher energy and food prices.

Inflation is expected to start moderating in the coming months, but will still remain at elevated levels.

Challenges:

Further implementation of structural reforms is needed to improve the competitiveness of the Spanish economy.

European Economy:

Growth:

The European economy experienced moderate growth in 2023.

Economic growth in Europe is expected to slow down in 2024, due to the war in Ukraine and rising interest rates.

Forecasts point to European GDP growth of 1.3% in 2024.

Inflation:

Inflation in Europe has increased significantly in recent months, reaching a year-on-year rate of 5.9% in March 2024.

Similar to Spain, this increase is mainly due to higher energy and food prices.

Inflation is expected to start moderating in the coming months, but will still remain at elevated levels.

Challenges:

The European economy faces significant challenges, including the war in Ukraine, the energy crisis, and rising interest rates.

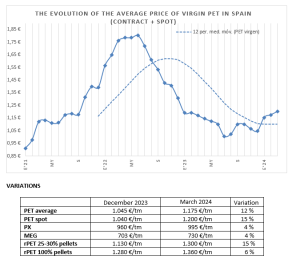

PET

PET purchases have accelerated in March in anticipation of the start of the summer season.

Production increases at some plants have been confirmed and most are starting to be “oversold.”

The outlook for April is positive, with continued pressure on supply and low availability.

Prices for all PET grades are expected to increase.

In any case, this year’s current pace of the average price of virgin PET is already 4.5% higher than that of 2023

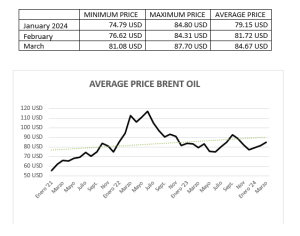

BRENT OIL

Demand: Expected to grow moderately in 2024.

Driving factors: Economic recovery in Asia. Resumption of international travel.

Uncertainties: War in Ukraine. New waves of COVID-19. Climate policies.

Price: Currently around $90 per barrel.

Significant increase since the beginning of the year. Short-term volatility. Range: $90-115 per barrel.

Sources: OPEC, IEA, Reuters

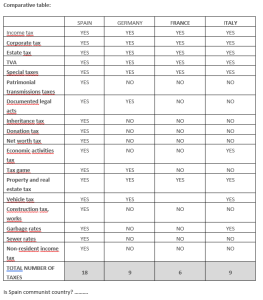

Spain towards a communist State? -2- (Drafting)

Tax Pressure in Spain vs. European Union (EU)

Recent trends:

Spain: 2018: 34.9% of GDP

2022: 38.3% of GDP

Increase: +3.4 points

Twice the increase of the EU

EU: 2018: 39.5% of GDP

2022: 41.2% of GDP

Increase: +1.7 points

RGPD: Data Protection Information of MARSELLÀ GLOBAL S.L. (smarsella@marsellaglobal.com):

PURPOSE: To inform you of our products and services by electronic means. LEGITIMATION: Legitimate interest in keeping you informed as a client and / or user. ASSIGNMENTS: Not contemplated. CONSERVATION: During the contractual relationship and / or until you request us to leave the business and, during the periods required by law to meet any responsibilities after the relationship ends. RIGHTS: You can exercise your right of access, rectification, deletion, portability of your data and limitation or opposition in the email address of the person in charge. In case of divergences, you can file a claim with the Data Protection Agency (www.aepd.es).

Este boletín está elaborado en base a la información y experiencia de nuestro equipo comercial. Marsella Global, SL presta especial atención a su elaboración, sin embargo, no podemos garantizar la exactitud y utilidad del contenido publicado.

El destinatario acepta el contenido de este boletín en el bien entendido de que Marsella Global, SL no se hace responsable de los daños causados por el uso de la información contenida en este documento.

Comments are closed.