Bulletin: 126

Date: March, 2021

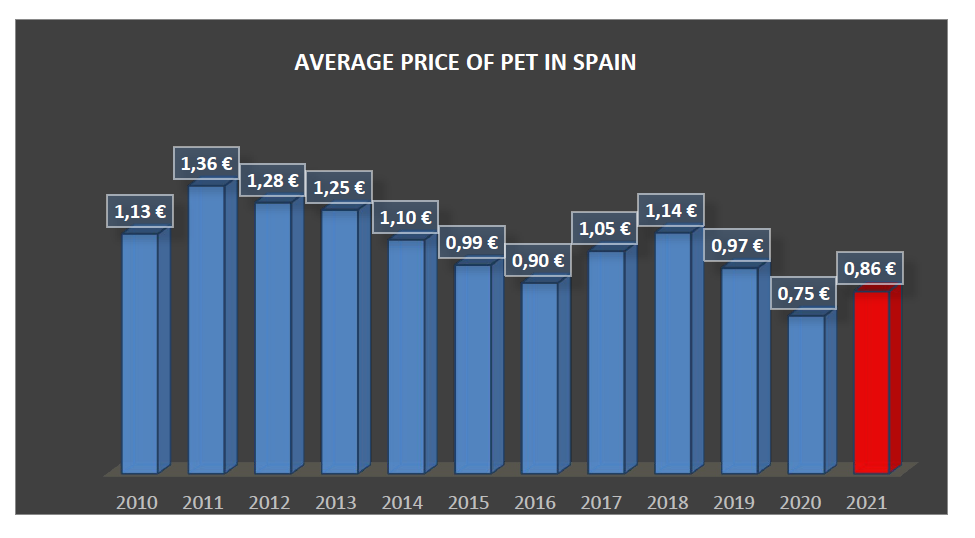

PET.- In just two months, the average price of PET already exceeds that of 2020 by 15%.

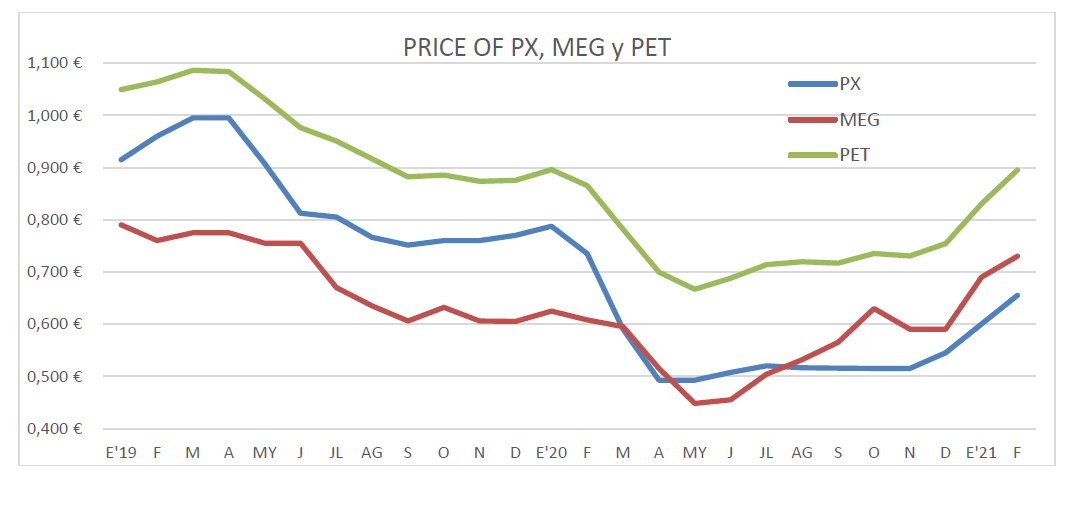

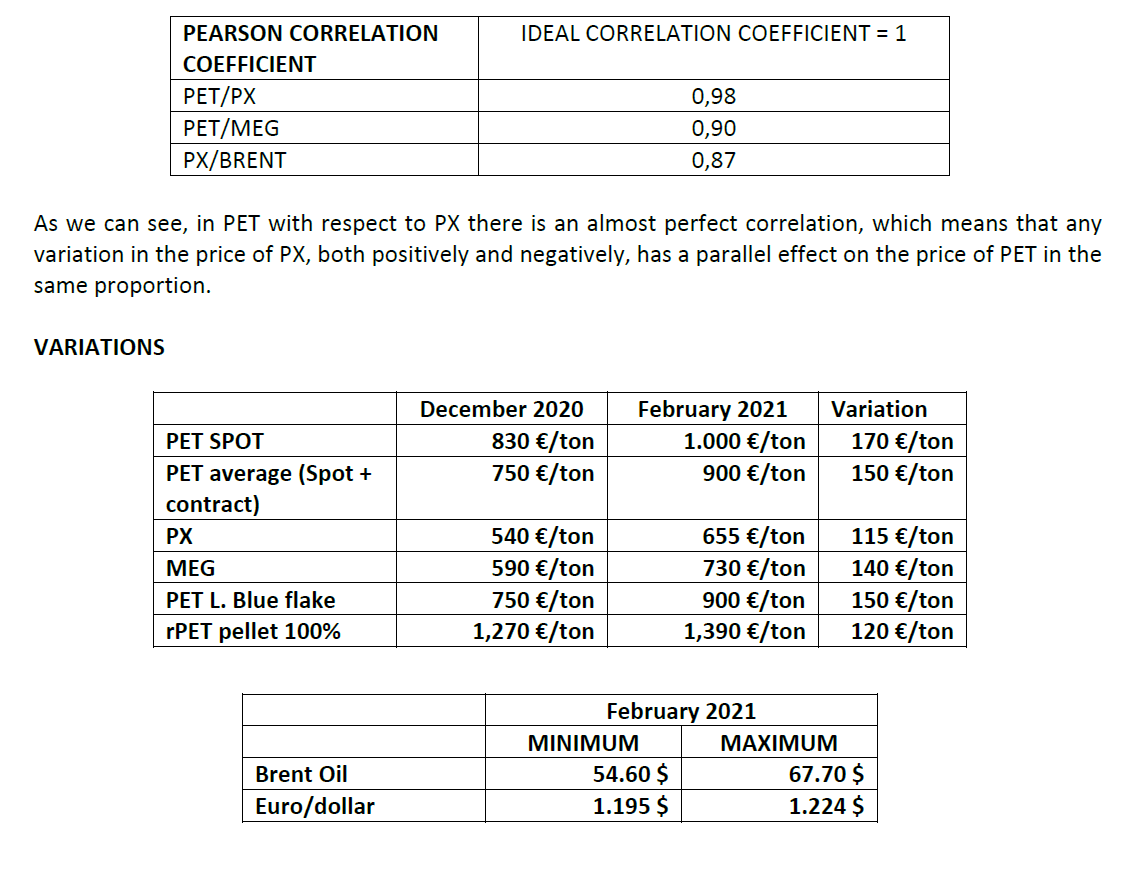

In February, the price of PET has already been quoted at € 150 a ton above the price sold in December last year.

Its raw materials such as PX and MEG are in February 115 € and 140 € respectively more expensive than in December.

Observing this graph we can deduce a great parallelism in the behavior of the three factors, but the most joint is the PX and the PET.

By doing a statistical analysis on their correlation coefficients, we effectively see that in the case of PET and PX there is almost a perfect correlation. Not so much in terms of the MEG, but quite close.

The study has been carried out taking the historical series of these three factors, plus Brent, from January 2019 to February of this year and the results have been:

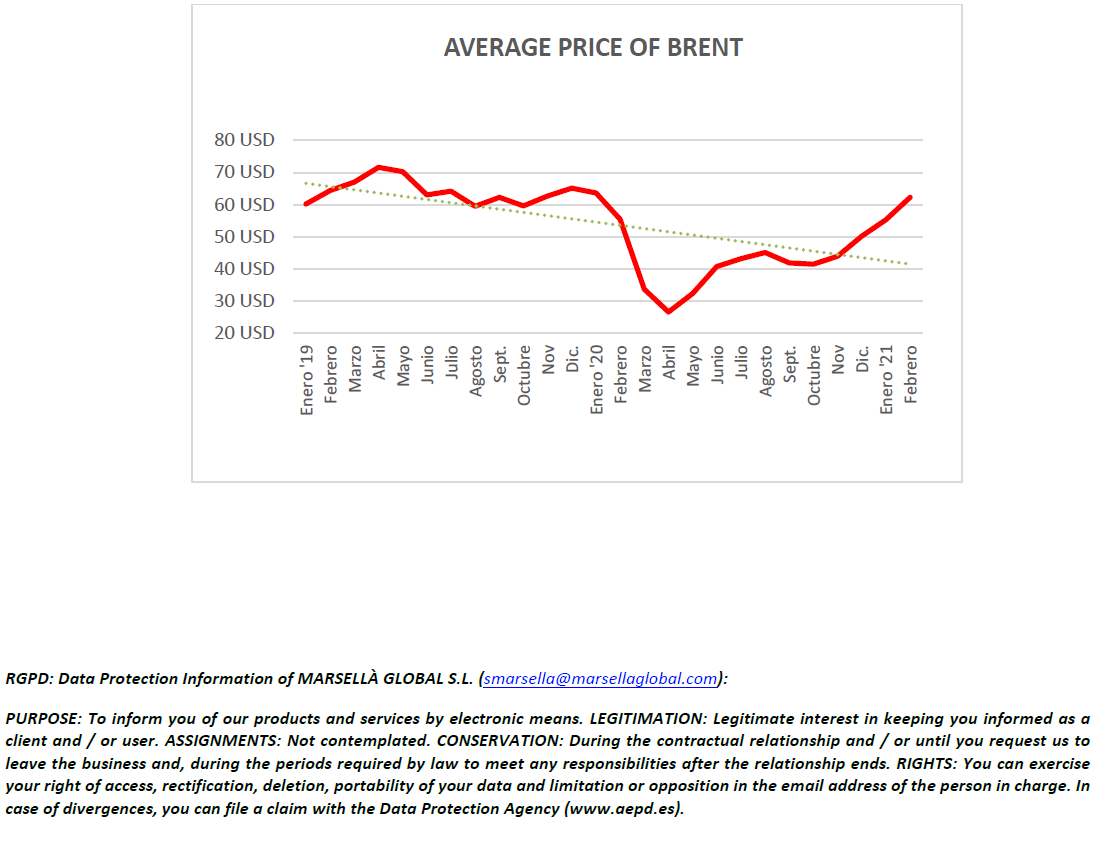

- BRENT OIL

In the midst of the COVID-19 pandemic, Brent on April 22, 2020 reached a historic low of 15.98 USD a barrel. Since then it has been recovering until reaching a maximum price of USD 67.70 this February.

Apart from the economic recovery in recent months, a determining factor in the recovery in oil prices has been the reduction in production by OPEC.

Some analysts such as Goldman Sachs and Morgan Stanley predict that Brent will reach 70 dollars on average in the end of next quarter, although due to the current trend ($ 62.24 in February) it could be much earlier.

Este boletín está elaborado en base a la información y experiencia de nuestro equipo comercial. Marsella Global, SL presta especial atención a su elaboración, sin embargo, no podemos garantizar la exactitud y utilidad del contenido publicado.

El destinatario acepta el contenido de este boletín en el bien entendido de que Marsella Global, SL no se hace responsable de los daños causados por el uso de la información contenida en este documento.

Comments are closed.