Bulletin: 168

Date: 13th March 2024

INTRODUCTION

The Spanish economy has grown at a moderate pace in the early months of 2024. GDP is estimated to have increased by 0.3% in the first quarter and a 0.4% increase is expected for the second. This growth is being driven by:

Domestic consumption: Consumer confidence has remained at positive levels and consumption expenditure has slightly increased; while exports have grown at a faster pace than imports, contributing to GDP growth.

Inflation: The annual inflation rate stood at 5.9% in February, the highest since 1992. Inflation is being driven by: Rising energy prices: Oil and natural gas prices have increased significantly in recent months, and supply chain issues have also led to price hikes for some goods.

Labour market: The unemployment rate stood at 12.3% in February, the lowest since 2008.

Public debt: Public debt remains at a high level, around 95% of GDP. The Spanish government has taken measures to reduce public debt, but the process will be gradual.

Risks: The main risks to the Spanish economy are:

The war in Ukraine: The war in Ukraine could have a negative impact on the Spanish economy, especially through increased energy prices.

Rising interest rates: Rising interest rates could slow economic growth and increase financing costs for businesses and households.

Inflation: Inflation could erode household purchasing power and reduce consumption.

Outlook: The Spanish economy is expected to grow by 4.2% in 2024. This growth will be driven by domestic consumption, exports, and investment. Inflation is expected to moderate in the coming months, but will remain at a high level. The labour market is expected to continue improving, with a reduction in the unemployment rate.

PET.- February can be considered a transition month awaiting the start of the summer season in March.

In this regard, some producers have started to reactivate idle production lines, so supply will increase shortly.

In terms of prices, virgin PET has experienced a slight increase of about €20/mt in February, far from what was expected given the situation in the Red Sea, which delays the supply of imported PET and its raw materials from Asia.

In any case, this year’s current pace of the average price of virgin PET is already 4.5% higher than that of 2023

BRENT OIL

Outlook: The Brent oil market is expected to remain volatile in the coming months.

The main factors influencing the price will be the developments in the war in Ukraine, global economic recovery, monetary policy decisions, and actions of the OPEC+.

Forecasts suggest an average price between $90 and $100 per barrel for 2024, although there is a considerable margin of uncertainty.

Sources: OPEC, IEA, Reuters

Spain towards a communist State? (Drafting)

In recent years, there has been a growing debate about Spain’s tendency towards a socio-communist state. One of the central arguments of this position is based on the high tax rates that apply to both companies and citizens.

Personal Income Tax: Spain has one of the highest personal income tax rates in Europe, with 45% for incomes over 60,000 euros. We are only surpassed by Portugal, which has a tax rate of 48% while Italy has 43% and Germany 42%.

Corporate Tax: The general corporate tax rate in Spain is 25%, one of the highest in the European Union, while the lowest rates are held by Portugal with 21%, and the United Kingdom with 19%. and Germany with 15.83%

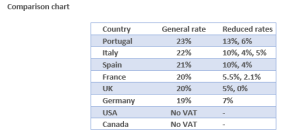

OECD VAT: The general VAT in Spain is 21%

Most OECD countries have a general VAT rate between 15% and 25%.

The countries with the highest overall rate are: Hungary (27%), Denmark (25%) and Sweden (25%).

The countries with the lowest overall rate are: Mexico (16%), Japan (10%) and South Korea (10%).

Many OECD countries also have one or more reduced VAT rates for certain goods and services, such as food, medicines, books and public transport.

Some countries, such as the United States and Canada, do not have VAT.

Some goods and services are exempt from VAT in most OECD countries, such as education, health and financial services.

Defenders of high tax rates in Spain as a tool for the redistribution of wealth argue that they are necessary to reduce economic inequality and finance social programs such as education, immigration integration, equality policies, healthcare and pensions. .

However, from the perspective of investors, high tax rates represent a disincentive for investment and economic growth, by reducing the profitability of companies and the purchasing power of citizens.

Another important and disincentive aspect is the low efficiency of public spending in Spain, since there is a high level of bureaucracy and that does not always translate into better services for citizens.

Is Spain communist? ……….

RGPD: Data Protection Information of MARSELLÀ GLOBAL S.L. (smarsella@marsellaglobal.com):

PURPOSE: To inform you of our products and services by electronic means. LEGITIMATION: Legitimate interest in keeping you informed as a client and / or user. ASSIGNMENTS: Not contemplated. CONSERVATION: During the contractual relationship and / or until you request us to leave the business and, during the periods required by law to meet any responsibilities after the relationship ends. RIGHTS: You can exercise your right of access, rectification, deletion, portability of your data and limitation or opposition in the email address of the person in charge. In case of divergences, you can file a claim with the Data Protection Agency (www.aepd.es).

Este boletín está elaborado en base a la información y experiencia de nuestro equipo comercial. Marsella Global, SL presta especial atención a su elaboración, sin embargo, no podemos garantizar la exactitud y utilidad del contenido publicado.

El destinatario acepta el contenido de este boletín en el bien entendido de que Marsella Global, SL no se hace responsable de los daños causados por el uso de la información contenida en este documento.

Comments are closed.