Newsletter: 170

Date: May 2, 2024

ECONOMIC SITUATION

External Context Global economic activity is showing signs of stabilizing.

Global GDP growth in 2024 has been revised slightly upwards in recent months, although it would remain at moderate rates in historical terms.

The process of disinflation on a global scale continues, even somewhat faster than expected in some regions.

Energy prices on international markets have continued to fall, especially in the case of natural gas, contributing to the dynamism of activity and the moderation of inflation.

The central banks of the main advanced economies are keeping their official interest rates unchanged, although financial markets anticipate that they will begin a cycle of declines in the coming months.

Despite the recent uptick in long-term interest rates, the world’s major stock indices have risen sharply during the quarter and risk premiums have remained low.

Recent Developments in the Spanish Economy

In the fourth quarter of 2023, there was an unexpected acceleration in GDP growth, and the GDP rates of change in the second and third quarters were also revised upwards.

Private consumption is the main driver of growth, driven by labour market resilience and rising real incomes. Inflation is expected to ease over the course of the year, which should further support consumer spending.

Job creation continues to be dynamic, helped by the boost of foreign nationals. However, some challenges remain, such as the high rate of youth unemployment and job insecurity.

Inflation

Asustained,butgradual,fallininflationintheeuroareaisexpectedthroughout2024,withvaluesstillabove,butcloseto,2%bytheendof the year.

Inflation has risen sharply in recent months, mainly due to rising energy and commodity prices. However, inflation is expected to moderate in the coming months, reaching around 3% in 2024 and 2.3% in 2025.

Public debt: (Source: Expansión)

In 2023, public debt in Spain was €1,573,754 million, growing by €70,955 million from 2022 when it was €1,502,799 million, it is among the countries with the most debt in the world.

This figure means that debt in 2023 reached 107.7% of Spain’s GDP, a drop of 3.9 points compared to 2022, when debt was 111.6% of GDP. Spain is among the countries with the highest debt to GDP in the world.

If we look at the tables, we can see the evolution of public debt in Spain. This has grown since 2013 in terms of global debt, when it was 1,025,655 million euros, and also as a percentage of GDP, which was 100.5%.

According to the latest published data, the per capita debt in Spain in 2023 was 32,386 euros per inhabitant, so its inhabitants are among the most indebted in the world. In 2022 it was €31,277, so there has been an increase in debt per capita of €1,109.

It is interesting to look back to see that in 2016 the debt per person was 24,610 euros.

| YEAR | Total debt MM €

|

Debt % GDP

|

Debt per capita |

| 2023 | 1,573,754 | 107.70 % | 32,386 € |

| 2022 | 1,502,799 | 111,60 % | 31,277 € |

| 2021 | 1,428,133 | 116.80 % | 30,074 € |

| 2020 | 1,345,786 | 120.30 % | 28,393 € |

| 2019 | 1,223,355 | 98.20 % | 25,846 € |

| 2018 | 1,208,861 | 100.40 % | 25,755 € |

| 2017 | 1,183,412 | 101.80 % | 25,363 € |

| 2016 | 1,145,050 | 102.70 % | 24,610 € |

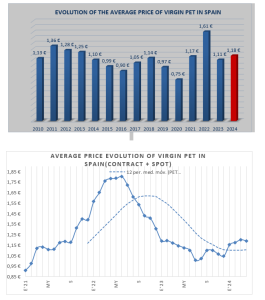

PET

In April, purchases, apart from contract purchases, have been focused on specific moments and to cover short-term needs.

Contrary to what might have been expected, in view of the evolution of its raw materials, the price has not only not increased, but has suffered a decrease in the spot market of €30 to €50/mt.

Looking ahead to May, demand is uncertain and the first offers are slightly lower than those of April.

VARIATIONS

| December 2023 | April 2024 | Variation | |

| PET average | 1,045 €/tm | 1,190 €/tm | 14 % |

| PET spot | 1,040 €/tm | 1,200 €/tm | 15 % |

| PX | 960 €/tm | 1,038 €/tm | 8 % |

| MEG | 703 €/tm | 780 €/tm | 11 % |

| rPET 25-30% pellets | 1,130 €/tm | 1,360 €/tm | 20 % |

| rPET 100% pellets | 1,280 €/tm | 1,620 €/tm | 27 % |

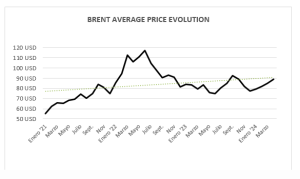

BRENT

Global demand for Brent oil is expected to continue to grow over the next 6 months, driven by the economic recovery from the COVID-19 pandemic, increased industrial activity, and growth in emerging economies.

The International Energy Agency (IEA) forecasts global demand growth of 1.3 million barrels per day (mb/d) in 2024, with a further increase of 0.8 mb/d in 2025.

However, economic and geopolitical uncertainty could weigh on demand, especially if tensions between Russia and Ukraine escalate or if there is a recession in one of the world’s leading economies.

Price:

The price of Brent oil is likely to remain volatile over the next 6 months, subject to a number of factors, including:

OPEC+ supply: The Organization of the Petroleum Exporting Countries (OPEC) and its allies have agreed to gradually increase their oil production in 2024. However, OPEC+ could adjust its production policy in response to market conditions.

Oil demand from China, the world’s second-largest economy, is a major factor influencing the global price. Any significant change in demand from China could have a noticeable impact on prices.

Western sanctions imposed on Russia over its invasion of Ukraine have disrupted oil supplies, contributing to market volatility. The evolution of sanctions and the situation in Ukraine will continue to be important factors to consider.

Financial speculators can also influence the price of Brent oil by buying and selling futures contracts. Some analysts’ price forecasts are:

JPMorgan: Forecasts that the price of Brent will average $83 per barrel in the second half of 2024, and then drop to $81 per barrel in the fourth quarter.

Goldman Sachs: Expects Brent to average $89 per barrel in the second half of 2024, and then rise to $92 per barrel in the fourth quarter.

Citibank: Forecasts that the price of Brent will average $86 per barrel in the second half of 2024, and then drop to $84 per barrel in the fourth quarter.

Sources: OPEP, AIE, Reuters

| MINIMUM PRICE | MAXIMUM PRICE | AVERAGE PRICE | |

| January 2024 | 74.79 USD | 84.80 USD | 79.15 USD |

| February | 76.62 USD | 84.31 USD | 81.72 USD |

| March | 81.08 USD | 87.70 USD | 84.67 USD |

| April | 85.79 USD | 92.18 USD | 89.00 USD |

Spain, towards a communist state? -3- (Editor)

TAX PRESSURE:

ClassifyingSpain’s personalincome tax burdenaccordingtopercapitaincomewithinEuropeisacomplexanalysisthatrequiresconsideringseveralfactors.

Ifwebaseourselvesonlyonthemaximummarginalpersonalincome tax rate,Spainisintheupper-middlepart.At47.2%,itisabovetheaveragefortheEU(41.2%)andtheeuroarea(41.9%).

However,thisdataisnotentirelyaccurate,asitdoesnottakeintoaccounttheprogressivestructureofpersonalincome tax orthevariousdeductionsandbenefitsexistingineachcountry.

Per capita income: By comparing the tax burden with per capita income, a more accurate view of citizens’ ability to pay is obtained. In this case, Spain is in a similar position to the average of the EU and the Eurozone.

| Country | Maximum marginal rate (%) | Personal Income Tax brackets | Deductions & Benefits |

| Sweden | 61,80% | 5 | Multiple deductions for children, housing, health, and education. |

| Denmark | 55,80% | 4 | Deductions for children, housing, and charitable donations. |

| Austria | 55,00% | 5 | Deductions for children, spouse, housing, and medical expenses. |

| Belgium | 53,70% | 4 | Deductions for children, housing, retirement savings, and charitable giving. |

| Netherlands | 52,00% | 3 | Deductions for children, housing, medical expenses, and charitable donations. |

| Finland | 51,60% | 5 | Deductions for children, housing, mortgage interest, and charitable gifts. |

| Slovenia | 50,00% | 7 | Deductions for children, spouse, housing, retirement savings, and charitable donations. |

| Spain | 49,10% | 6 | Deductions for children, spouse, housing, rent, charitable donations, and pension plans. |

| France | 49,00% | 5 | Deductions for children, spouse, housing, charitable donations, and work-related expenses. |

| Luxembourg | 48,70% | 3 | Deductions for children, housing, medical expenses, and charitable donations. |

| Portugal | 48,00% | 5 | Deductions for children, spouse, housing, medical expenses, and charitable gifts. |

| Germany | 47,50% | 6 | Deductions for children, spouse, housing, charitable donations, and work-related expenses. |

| Italy | 47,20% | 5 | Deductions for children, spouse, housing, mortgage interest, and charitable gifts. |

| Iceland | 46,00% | 4 | Deductions for children, spouse, housing, mortgage interest, and charitable gifts. |

| Ireland | 41,00% | 1 | Dependant Tax Credit, Rent and Medical Expense Allowance. |

| Greece | 40,00% | 5 | Deductions for children, spouse, housing, mortgage interest, and charitable gifts. |

| United Kingdom | 39,80% | 4 | Personal allowance, dividend rates, mortgage interest relief, and other deductions. |

| Cyprus | 35,00% | 5 | Deductions for children, spouse, housing, mortgage interest, and charitable gifts. |

| Norway | 32,40% | 3 | Deductions for children, spouse, housing, mortgage interest, and charitable gifts. |

| Bulgaria | 22,00% | 2 | Standard Dependant Deduction and Mortgage Interest Relief. |

| Switzerland | 11,50% | 3 | Canton and municipality deductions, deductions for children, spouse, housing, and charitable donations. |

SOCIAL CHARGE ON THE GDP OF COMPANIES

The social chargen on the GDP of European companies varies considerably between countries. In 2021, the European Union (EU-27) average was around 14.7%, but with significant differences between Member States.

SOCIAL CHARGE TABLE

| Countries | SOCIAL SECURITY S/GROSS SALARY |

| Italy | 31,6 % |

| France | 31,1 % |

| Austria | 29,9% |

| Germany | 29,3 % |

| Belgium | 28,3 % |

| Spain | 23,7 % |

| Sweden | 8,7 % |

| Denmark | 8,5 % |

| Malta | 8,3 % |

| Ireland | 8,1 % |

| Cyprus | 7,8 % |

Consequences of social charge:

A high social charge can adversely affect the competitiveness of firms, especially in labour-intensive sectors.

Companies may be disincentivized from hiring new workers if the social burden is too high.

The social charge can contribute to a greater redistribution of income, as it finances social benefits.

The social burden has been increasing in most European countries in recent decades, due to the ageing of the population and the increase in spending on social benefits. However, the recent trend is towards a stabilization or even a slight reduction in the social burden in some countries.

It’s communist Spain?………..

GDPR: Data Protection Information of MARSELLÀ GLOBAL S.L. (smarsella@marsellaglobal.com):

PURPOSE: To inform you about our products and services by electronic means. LEGITIMATION: Legitimate interest in keeping you informed as a customer and/or user. ASSIGNMENTS: Not contemplated. RETENTION: During the contractual relationship and/or until you request us to cancel the contract and, during the periods required by law to meet any liabilities at the end of the relationship. RIGHTS: You can exercise your right of access, rectification, deletion, portability of your data and limitation or opposition in the email address of the responsible party. In case of discrepancies, you can lodge a complaint with the Data Protection Agency (www.aepd.es).

Este boletín está elaborado en base a la información y experiencia de nuestro equipo comercial. Marsella Global, SL presta especial atención a su elaboración, sin embargo, no podemos garantizar la exactitud y utilidad del contenido publicado.

El destinatario acepta el contenido de este boletín en el bien entendido de que Marsella Global, SL no se hace responsable de los daños causados por el uso de la información contenida en este documento.

Comments are closed.