Newsletter: 171

Date: June 6, 2024

ECONOMIC SITUATION

Overall, the outlook for the European economy is uncertain.

The Eurozone economy grew by 0.3% in the first quarter of 2024, compared to the previous quarter and this growth is expected to continue for the rest of the year.

The unemployment rate in the Eurozone stood at 6.4% in April 2024, a slight decrease from previous months.

Meanwhile, the EU’s trade surplus in goods continues to grow. In the first quarter of 2024, exports increased by 0.3%, while imports decreased by 2.9%, while inflation, in the Eurozone, has moderated slightly in recent months, standing at 7.5% in May 2024. However, it remains a high level and a major concern for central banks.

Among the uncertainties mentioned at the beginning, the war in Ukraine continues to have a significant impact on the European economy for growth. Energy and food prices have risen sharply, which is reducing households’ purchasing power and fueling inflation.

Europe is facing an energy crisis due to its dependence on Russian natural gas. Countries are looking for alternatives to reduce this dependency, but this will take time and could be costly.

Political instability: Some European countries are facing political instability, which could discourage investment and hurt business confidence.

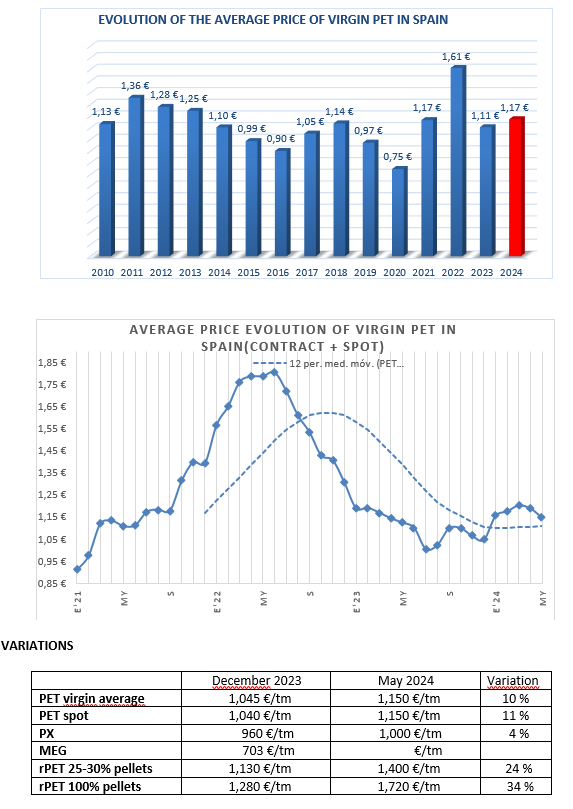

PET

Despite being fully in the middle of the summer campaign, the price of virgin PET in May has fallen again, contrary to what could be expected and as has been usual at the gates of summer.

The fall in the price of their raw materials and the increase in the consumption of the different types of RPET have been the causes of this decrease.

Faced with this situation, some PET producers are making strategic changes in their production policies, changing the production of virgin PET for RPET.

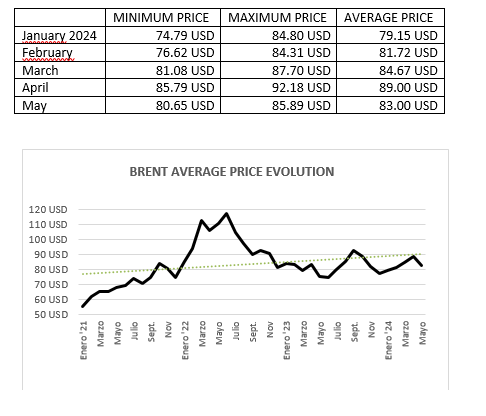

BRENT

Prices have been falling in recent weeks due to a number of factors, including:

- Concerns about a possible global recession: Investors fear that a recession could reduce demand for oil, leading to a drop in prices.

- OPEC’s production increase: The Organization of the Petroleum Exporting Countries (OPEC) has agreed to increase its crude oil production by 650,000 barrels per day starting in July 2024. This could help ease pressure on prices.

- The release of strategic petroleum reserves: The United States and other countries have released strategic petroleum reserves in an effort to reduce prices.

However, there are also some factors that could boost Brent prices in the near term:

- The war in Ukraine: The war in Ukraine continues to be a major factor of uncertainty in the market. If the war escalates, it could disrupt oil supplies and push prices higher.

- Seasonal demand: Oil demand typically increases during the summer, which could help support prices.

- Speculative Activities: Speculative Investors Could Return to the Stock Market

Sources: OPEP, AIE, Reuters

GDPR: Data Protection Information of MARSELLÀ GLOBAL S.L. (smarsella@marsellaglobal.com):

PURPOSE: To inform you about our products and services by electronic means. LEGITIMATION: Legitimate interest in keeping you informed as a customer and/or user. ASSIGNMENTS: Not contemplated. RETENTION: During the contractual relationship and/or until you request us to cancel the contract and, during the periods required by law to meet any liabilities at the end of the relationship. RIGHTS: You can exercise your right of access, rectification, deletion, portability of your data and limitation or opposition in the email address of the responsible party. In case of discrepancies, you can lodge a complaint with the Data Protection Agency (www.aepd.es).

Este boletín está elaborado en base a la información y experiencia de nuestro equipo comercial. Marsella Global, SL presta especial atención a su elaboración, sin embargo, no podemos garantizar la exactitud y utilidad del contenido publicado.

El destinatario acepta el contenido de este boletín en el bien entendido de que Marsella Global, SL no se hace responsable de los daños causados por el uso de la información contenida en este documento.

Comments are closed.